In today’s rapidly evolving digital landscape, financial services organizations are under immense pressure to innovate and adapt to stay competitive. With the increasing demand for seamless digital experiences, data-driven insights, and robust security measures, these organizations are turning to hybrid and multicloud strategies as a key enabler of their transformation journey. This blog explores the benefits, challenges, and best practices for implementing hybrid and multicloud strategies in the financial services sector.

Understanding Hybrid and Multicloud Strategies

What is a Hybrid Cloud?

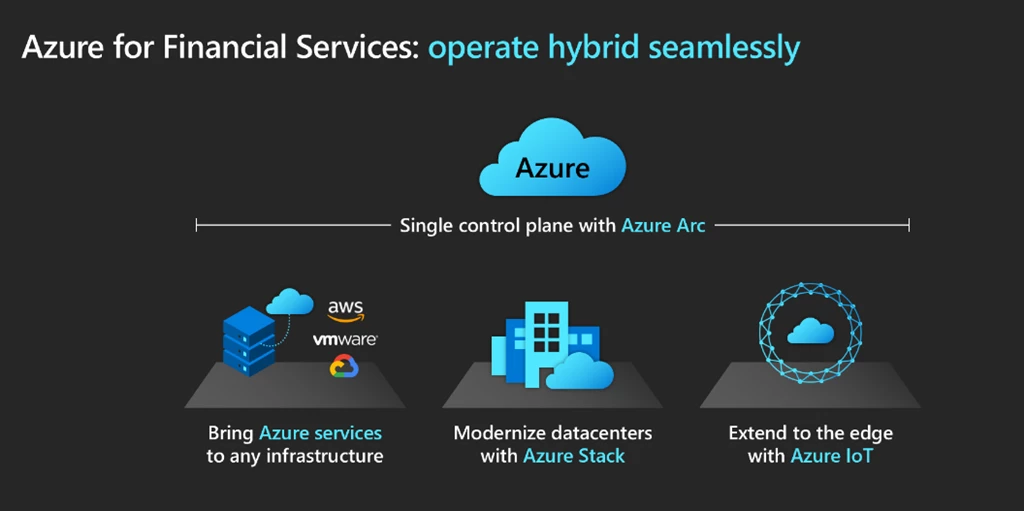

A hybrid cloud environment combines on-premises infrastructure, private cloud services, and public cloud services, allowing data and applications to be shared between them. This approach provides organizations with greater flexibility and more deployment options.

What is Multicloud?

A multicloud strategy involves using multiple cloud services from different providers. This can include a mix of public, private, and hybrid clouds, enabling organizations to leverage the best features and services from each provider.

Benefits of Hybrid and Multicloud Strategies

Enhanced Flexibility and Agility

Hybrid and multicloud strategies offer financial services organizations the flexibility to choose the right environment for each workload. This enables quicker adaptation to changing market conditions and customer demands. For instance, sensitive data can be kept on a private cloud for security, while less sensitive data can be processed on a public cloud to take advantage of scalability and cost efficiency.

Cost Optimization

By leveraging a combination of cloud services, organizations can optimize costs. They can avoid vendor lock-in, take advantage of competitive pricing, and utilize cost-effective cloud resources for non-critical applications while keeping critical applications on more secure and reliable platforms.

Improved Risk Management and Compliance

Financial services organizations are subject to stringent regulatory requirements. Hybrid and multicloud strategies allow for better risk management by enabling data and workloads to be distributed across multiple environments. This diversification minimizes the risk of downtime and data loss. Additionally, organizations can ensure compliance by keeping sensitive data within specific geographic boundaries as required by regulations.

Innovation and Modernization

The ability to access a wide range of cloud services from multiple providers accelerates innovation. Financial institutions can experiment with new technologies, such as artificial intelligence and machine learning, without significant upfront investments. This fosters a culture of innovation and helps organizations stay ahead of the competition.

Challenges of Hybrid and Multicloud Strategies

Complexity in Management

Managing multiple cloud environments can be complex and requires specialized skills. Organizations need to ensure seamless integration and interoperability between different cloud platforms. This complexity can be mitigated by adopting robust cloud management tools and platforms.

Security Concerns

While hybrid and multicloud strategies offer enhanced security, they also introduce new security challenges. Ensuring consistent security policies across all environments, managing identity and access controls, and protecting data in transit and at rest are critical considerations.

Compliance and Governance

Maintaining compliance with regulatory requirements across multiple cloud environments can be challenging. Financial services organizations must implement stringent governance frameworks to ensure data privacy, security, and compliance.

Best Practices for Implementing Hybrid and Multicloud Strategies

Develop a Comprehensive Cloud Strategy

Before embarking on a hybrid or multicloud journey, financial services organizations should develop a comprehensive cloud strategy. This strategy should outline the goals, objectives, and key performance indicators (KPIs) for cloud adoption. It should also include a detailed assessment of current infrastructure, applications, and workloads.

Prioritize Security and Compliance

Security and compliance should be at the forefront of any hybrid or multicloud strategy. Implement robust security measures, such as encryption, multi-factor authentication, and regular security audits. Ensure compliance with industry regulations by leveraging cloud providers’ compliance certifications and implementing strict data governance policies.

Leverage Cloud Management Tools

Invest in cloud management tools and platforms that provide visibility, control, and automation across multiple cloud environments. These tools can help streamline operations, optimize resource utilization, and ensure consistent security and compliance policies.

Foster a Culture of Continuous Learning and Innovation

Encourage continuous learning and innovation within the organization. Provide training and development opportunities for employees to build cloud expertise. Foster a culture of experimentation and collaboration to drive innovation and stay ahead of the competition.

Partner with Experienced Cloud Providers

Partnering with experienced cloud providers can significantly simplify the implementation and management of hybrid and multicloud environments. Choose providers with a proven track record in the financial services industry and leverage their expertise to navigate complex regulatory requirements and security challenges.

Conclusion

Hybrid and multicloud strategies offer financial services organizations a powerful way to enhance flexibility, optimize costs, improve risk management, and drive innovation. By carefully considering the benefits, challenges, and best practices outlined in this blog, financial institutions can successfully navigate their cloud journey and achieve their digital transformation goals. Embracing these strategies will not only future-proof their operations but also enable them to deliver superior customer experiences in an increasingly competitive market.